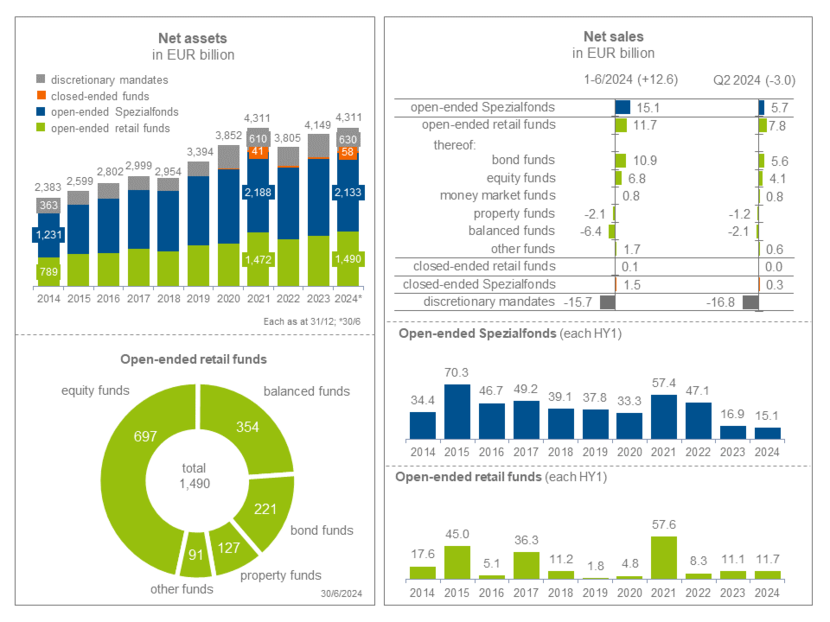

Half-year figures: German fund industry grows over EUR 4,300 billion AuM

- Retail funds and Spezialfonds attract EUR 28 billion in new money

- Inflow for bond funds and equity funds, outflow for balanced funds and property funds

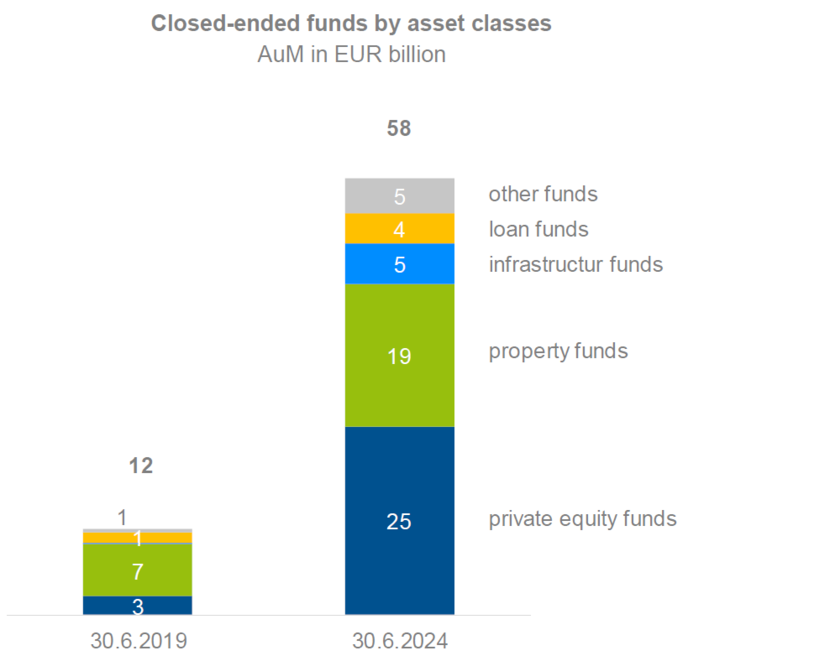

- Spezialfonds manage EUR 1,300 billion for pension schemes and insurers

- Private equity is the largest group of closed-ended funds

Fund companies had a total of EUR 4,311 billion AuM for investors in Germany as at 30 June 2024. With this, the industry reached the same record level as at the end of 2021. Assets have almost doubled in the last ten years (30 June 2014: EUR 2,239 billion). This corresponds to an average increase of just under seven per cent per year. At EUR 2,133 billion, the majority of total AuM is invested in open-ended Spezialfonds. The fund companies manage EUR 1,490 billion in open-ended retail funds, EUR 630 billion in discretionary mandates and EUR 58 billion in closed-ended funds.

While investment funds received a net amount of EUR 28.3 billion in new money in the first half of 2024, institutional investors withdrew EUR 15.7 billion from mandates.

New business in open-ended retail funds totalled EUR 11.7 billion. Bond funds lead the sales list with EUR 10.9 billion. This is dominated by funds that invest in bonds with a remaining term of up to three years (EUR 8.2 billion). The following are equity funds with EUR 6.8 billion. Equity ETFs received EUR 9.5 billion, while actively managed funds saw an outflow of EUR 2.7 billion. Balanced funds recorded an outflow of EUR 6.4 billion. Property funds recorded redemptions in each of the last eleven months, totalling EUR 3.1 billion. In the first half of 2024 alone, there was an outflow of EUR 2.1 billion. Net fund assets have fallen from EUR 131 to 127 billion since the beginning of the year, also due to devaluations of properties in the portfolios of some funds. Its share of retail funds’ AuM is eight per cent. At EUR 697 billion, equity funds have a share of 47 per cent. Their volume has risen by almost twelve per cent since the beginning of the year (EUR 624 billion). This is followed by balanced funds with EUR 354 billion (beginning of the year: EUR 338 billion) and bond funds with EUR 221 billion (EUR 211 billion).

Retirement benefit schemes (e. g. pension schemes, pension funds) are the largest investor group among open-ended Spezialfonds, with EUR 753 billion. By mid-2019, their assets totalled EUR 521 billion. This corresponds to an increase of 45 per cent, which is primarily due to high inflows of funds. Insurers follow in second place with EUR 524 billion. Their Spezialfonds’ assets have decreased over the last five Spezialfonds’ assets have decreased over the last five years, as price losses due to higher interest rates have had a particularly noticeable impact on them. For regulatory reasons, insurance companies hold a high proportion of bonds in their Spezialfonds. The Spezialfonds’ AuM of non-profit organisations (e. g. churches), credit institutions, manufacturing and service companies (ex financial services) have increased since mid-2019.

The AuM of closed-ended funds managed by BVI members have risen from EUR 12 to 58 billion in the last five years. Private equity funds are the largest group, accounting for 43 per cent of the net assets of closed-ended funds. Property funds have a market share of 33 per cent. By mid-2019, they accounted for just under 60 per cent. Infrastructure funds and credit funds also play an important role. The market for closed-ended funds is dominated by institutional investors: At EUR 55 billion, Spezialfonds manage 95 per cent of net assets. The closed-ended retail funds (EUR 3 billion) mainly invest in property.

Download press release (PDF)